Business Central has the capability to manage Cash accounting VAT.

What is cash accounting VAT?

Where VAT is declared and reclaimed on payment of invoices and credits rather than the invoice date.

Unrealised VAT is how business central manages VAT cash accounting.

How to set up Unrealised VAT or VAT cash accounting in business central.

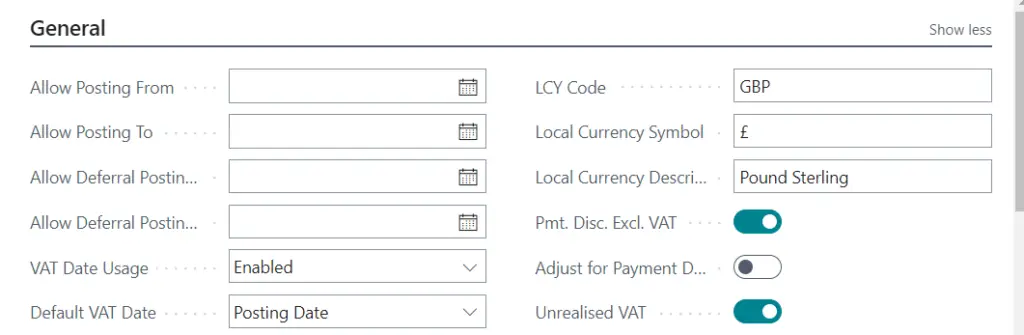

Go to General ledger set up using the search bar

Under the General Fast Tab toggle on Unrealised VAT

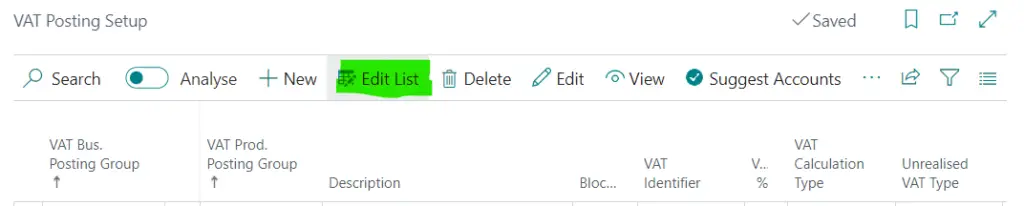

Going back to the search bar go to VAT posting set up

Choose the relevant VAT Bus. Product Posting group by clicking it and then click edit at the top

This will open up the VAT posting set up card.

Enter a description – suggestion Unrealised VAT on Sales.

Enter the VAT percentage

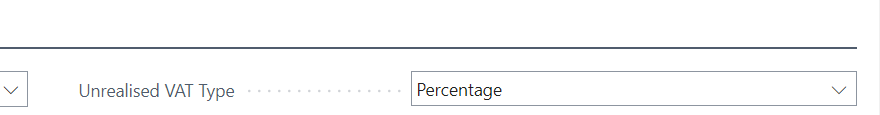

Choose the Unrealised VAT type.

What doe the Unrealised VAT types mean in business central?

BLANK – This will not use Unrealised VAT for this posting group.

PERCENTAGE – this allocates the payment to the VAT in the same percentage as for the invoice.

Its sounds more complicated than it is – so if 40% of a invoice is paid 40% of the VAT is realised and declared on the next VAT return.

FIRST option – Any payments are allocated to the VAT first, so VAT is realised in full even if there is a balance on that invoice. As long as the full amount of VAT has been paid.

LAST option – the opposite the payment is allocated to the net amount of the invoice first in full then the VAT. So if 40% of invoice is paid no VAT is realised, on full payment of the invoice all of the VAT is realised and declared on the next VAT return.

FIRST (fully paid) The same as the FIRST option but the Unrealised VAT is realized or transferred once the invoice has been fully paid.

LAST (fully paid) the same as the LAST option but the Unrealised VAT is realized or transferred once the invoice has been fully paid.

Enter a G/L Account for Unrealised VAT under the sales and purchase VAT Unreal. Account fields.

The Unrealised VAT entries page can be filtered to show all that are still to be transferred and declared on future VAT returns.

Hopefully this explains VAT cash accounting in dynamics 365 any questions please drop a comment below.