If you have not come across this blog before or have not read the about me bio I am a qualified accountant who now consultants in finance/business systems in particular Microsoft Business Central.

So why are we talking about Xero?

I work with many systems not just business central and have many years of experience using and working with other smaller accounting packages such as Sage, Xero and Quickbooks.

A regular topic that I get asked to consultant on is VAT problems in the system.

This is mainly due to the user not understanding how to use the system and making user errors.

Xero is a popular accounting package in the UK and its easy to see why, its very user friendly and easy to use.

The monthly cost is not too expensive.

Lets walk through how to set up MTD in Xero

Step 1: Navigate to VAT Returns

From the top ribbon click accounting and then reports.

Click UK VAT Return. (If it is not set as a favourite it can be found under Taxes and Balances in Reports)

Step 2: Set up MTD for VAT in Xero.

Click the above field.

Step 3: Connect to HMRC

Xero will send you to the HMRC/GOV wesbite click continue.

Enter your Government Gateway User ID and Password and sign in.

Step 4: Grant authority

Once successful authorisation has happened Xero is now set up for MTD.

I have created an independent guide to setting up and submitting VAT Returns in Xero.

Including how to reconcile the VAT to the trail balance, with reconciliation tips if it does not balance.

The above MTD set up is taken from the guide.

You can purchase the full guide below.

A Guide to setup, submit and reconcile VAT in XERO.

A broken down step by step independent guide to setting up VAT, MTD setup, submitting returns under MTD and how to reconcile VAT to the trial balance in your Xero accounting system for your business.

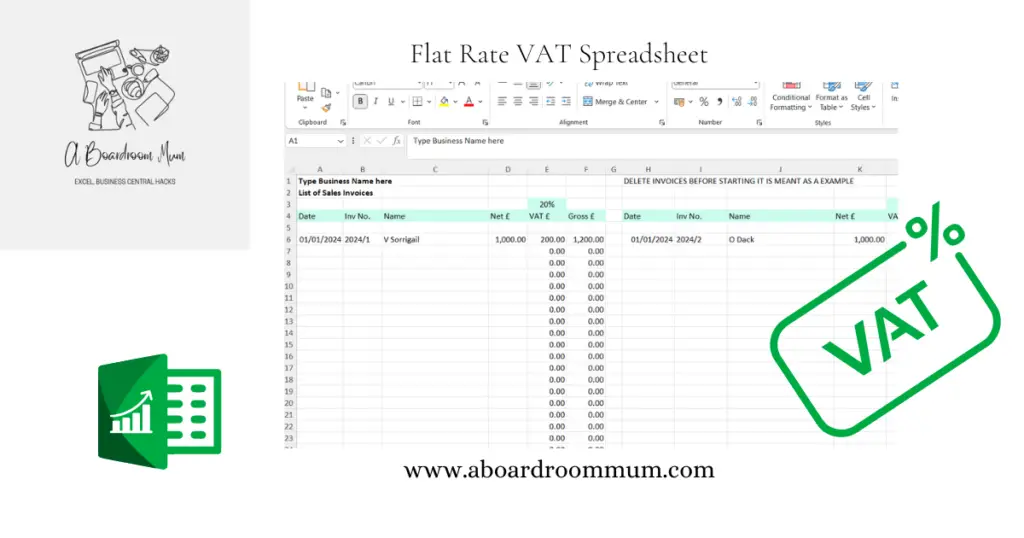

Flat Rate VAT Scheme Excel Template

With how to use guide. Suitable for use with a bridging tool.

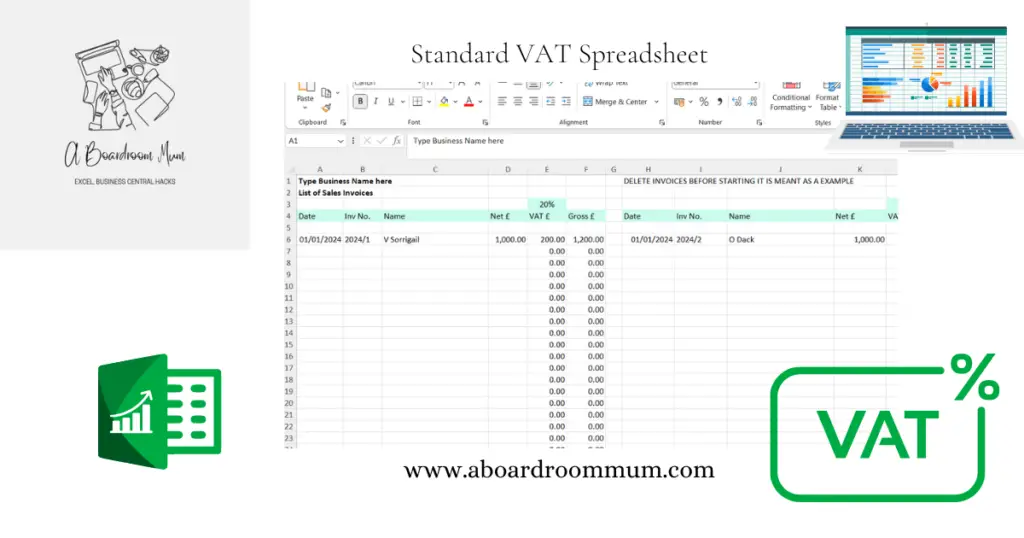

Standard VAT Excel Template

Easy to use Excel template for UK standard VAT. Suitable to use with a bridging tool.

Pay Off Debt Goal Tracker

Notes included on how to use the template.